Fed signals impending reduction but keeps interest rates unchanged.

In the US, the rate of inflation was 3.1% in January and 3.2% last month.

“We’re not going to overreact to these two months of data, nor are we going to ignore them,” he stated.

Forecasts for the next year indicated greater rates than originally anticipated by officials. However, the overall picture points to the bank’s increasing confidence in its ability to control inflation without destabilizing the economy.

However, he cautioned that other nations’ economies would suffer if the US decided to maintain higher interest rates for longer than anticipated due to its robust growth.

Foreign investment has dramatically slowed in emerging markets as investors move their money to more developed nations like the US in reaction to rising interest rates.

He cautioned, however, that there would be local consequences associated with those actions, which raised rates to more than 20% in Egypt and Nigeria.

“The premium [to which] these guys will have to push their rates… will put stress on the economies,” he stated. “If now we’re in the scenario where the US is going to keep rates higher for longer, it’s going to be a challenge for quite a few of the emerging market countries.”

Other stories

-

European equities close 1% higher; the Stoxx 600 crossed the 500-point mark for the first time

-

In January, China’s manufacturing output declined for the fourth consecutive month

-

The expense of tax compliance is too high for MSMEs — PEF

-

Cardi B and Offset unfollow each other, which reignites rumors of a divorce.

-

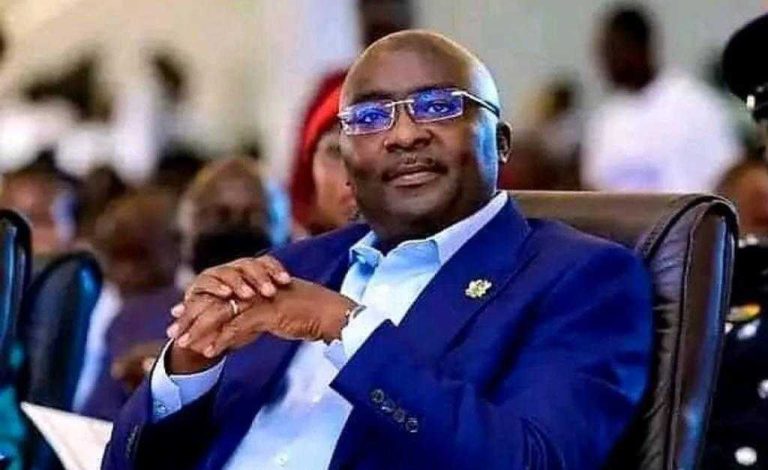

Sam George ‘descends’ on Bawumia; a religious ‘prostitute’ cannot be our president