Swiss Re, the insurance behemoth, reports a 580% increase in full-year earnings and alerts customers about climate-related costs.

Christian Mumenthaler, CEO of Swiss Re, expressed his happiness with the company’s 2023 performance and the company’s optimistic outlook on CNBC’s “Squawk Box Europe” on Friday.

When asked if the insurance and reinsurance sectors had been raising rates excessively and causing an inflationary issue, Mumenthaler of Swiss Re responded as follows:

“In the end, putting a fair price on risk is the role of insurance, and reinsurance in particular, and I believe we have been lagging a little bit in the last few years.” Insurance for insurance firms is referred to as reinsurance.

Mumenthaler foresaw that consumers would soon be paying the price of the climate catastrophe for the first time.

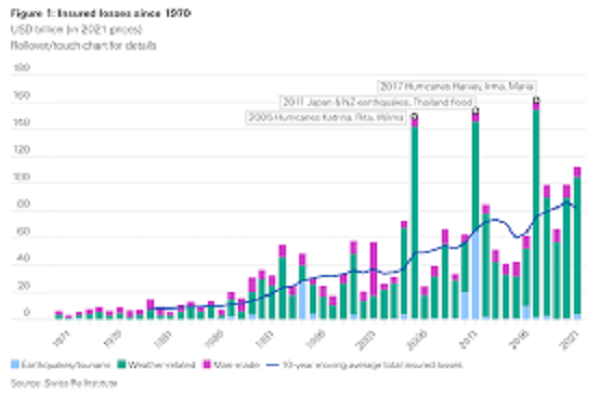

Risks have significantly grown as a result of climate change, and this was seen in our profits, which have fallen short over the past few years. Thus, this is a response, a reevaluation of the danger,” he continued.