China is creating "hidden" debt through its loans to other nations. That might be an issue.

Speaking last year, David Malpass, the current president of the World Bank and the former U.S. Treasury Undersecretary for International Affairs, gave an example of these opaque loans: Chinese loans to Venezuela were expressed in barrels of oil. He claimed that this had the effect of hiding the precise sum of money that China had paid Venezuelan officials and that the country’s citizens would likely pay China going forward.

In his remark, he declared, “You will not find China’s terms if you ask for them.”

During their annual spring meetings in April of this year, the World Bank and the IMF both demanded greater transparency over those loan amounts and terms.

In order for borrowers to make wise decisions, they require fast and thorough debt data. Additionally, it enables lenders to better control loan risks, which lowers lending costs for all borrowers, according to the statement.

Additionally, according to the international organization, debt transparency enables people to “hold their governments accountable.”

To put it briefly, debt transparency is crucial to economic growth. Therefore, when debts are “hidden,” it affects not just the World Bank or the IMF but also everyone else. Uncertainty can result in increased funding costs or, in the worst-case scenario, cut off funding, which is particularly problematic for the inhabitants of nations whose concealed debt is unexpectedly uncovered, according to a World Bank statement.

Debt accumulation may be an issue.

The scenario with the underreported debt could be problematic, says Kaho Yu, a senior Asia analyst at Verisk Maplecroft.

He sent an email to CNBC saying, “Even though Beijing’s lending can help developing countries, an opaque build-up of debt may eventually drag down economic growth.”

Yu said, “China may have promised the developing nations that, once the projects are operational, the cost of the loans will be reimbursed in the long term, but no assurance is given.”

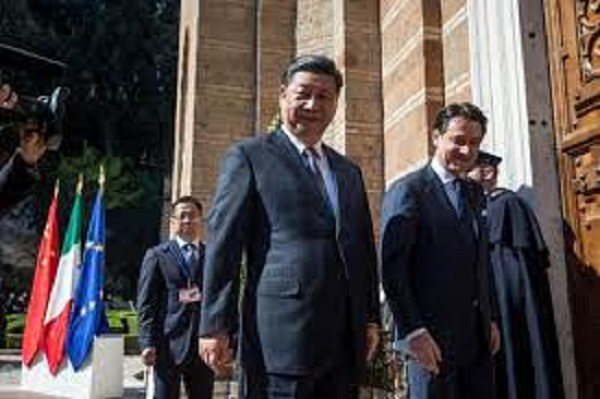

With the Belt and Road Initiative, a massive infrastructure investment plan to create rail, road, maritime, and other links reaching from China to Central Asia, Africa, and Europe, China has come under fire for putting many other nations in debt.

During a speech at the second Belt and Road Forum in Beijing early last month, People’s Bank of China Governor Yi Gang stated that Chinese financial institutions have contributed more than $440 billion in funding for Belt and Road projects.

The Export-Import Bank of China and the China Development Bank are the two policy banks that handle a large portion of the lending. In April, the China Export-Import Bank said that it had lent over $149 billion to over 1,800 Belt and Road projects. Meanwhile, the China Development Bank reported in March that it had funded over $190 billion worth of Belt and Road projects since 2013.