-

Bitcoin Price Prediction

- Bitcoin’s long-awaited “taproot” update is now live. The update continues to improve the functionality and utility of BTC as money.

- If we’re being honest with ourselves, most people in the West simply use BTC for speculation, but continued improvement in BTC technology has massive potential to drive adoption in emerging markets.

- Bitcoin’s price is likely to keep rising as long as US monetary policy remains historically loose and no black swans pop up.

- Where I think BTC is headed going into 2022.

shannonstent/E+ via Getty Images How Bitcoin Did in 2021

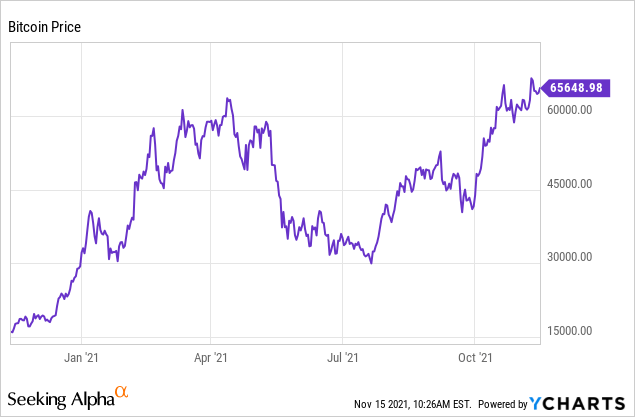

Bitcoin (BTC-USD) is in rally mode again, currently hovering slightly below its all-time high set earlier this month. In all, BTC is up about 123% for 2021 as of my writing this.BTC essentially has had three phases in 2021.

- Boom 1.0- January-April. Stimulus checks, ultra-easy Fed policy, and consumers stuck at home meant traders dove headfirst into every speculative asset class, from meme stocks to crypto. Bitcoin’s underlying adoption drivers remained strong, but the size of the move combined with the short period of time in which it happened led to obvious questions about how sustainable it was.

- The bust- April- August. China cracked down on BTC mining, Elon Musk questioned whether Bitcoin’s electricity usage was worth the cost & environmental impact, and many speculators exited the market. Bitcoin miners migrated from China to Texas, Washington, and other US states with abundant/cheap electricity. Bitcoin got cut in half.

- Boom 2.0–August-present. El Salvador made Bitcoin legal tender, the first Bitcoin futures ETF was approved by the SEC, and adoption continues to increase. Fear of missing out (“FOMO”) is again driving more investors back into BTC.

Data by YCharts What Bitcoin Catalysts Should Be Watched?

- There’s a new update out known as Taproot that upgrades Bitcoin’s technology. Taproot improves privacy, reduces fees, helps support the Lightning Network, and paves the way for “smart contracts.” Smart contracts sound intimidating, but if you’ve ever used a vending machine, you’ve used a smart contract (programmed into the machine). If you’ve ever lost a dollar to a slot machine, you’ve also interacted with a smart contract. Just as vending machines allow you to put in money and be dispensed a soda and slot machines allow you to lose a dollar for a chance at $50,000, Bitcoin smart contracts could have applications for gambling, insurance, real estate transactions, inheritances, and more.

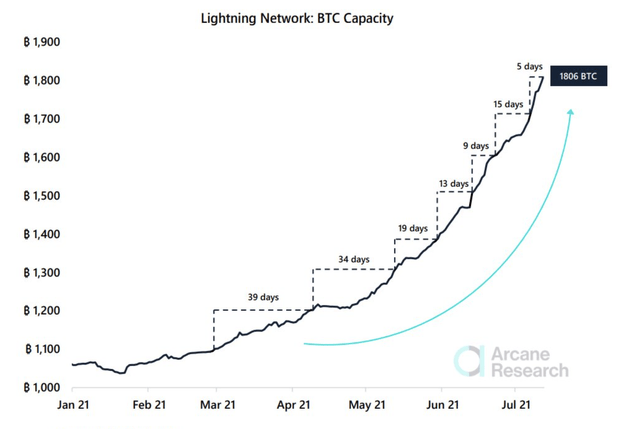

- I see particular potential for smart contracts easing the risks of doing business in emerging markets that lack the rule of law that the United States and other Western countries have. The Lightning Network, another key emerging-market puzzle piece for Bitcoin, continues to grow rapidly. What’s mind-blowing about the Taproot upgrade is that the update has been done without any centralized development team, which has super interesting implications for the politics and economics of money.

Source: Bitcoin Visuals

- Bitcoin is commonly criticized for being too speculative, and it’s possible the current wave is outrunning the underlying technological potential of BTC in the short run. But with the US Federal Reserve currently running some of the loosest monetary policy in history, with 6-7% inflation and 0% interest rates, the US dollar doesn’t exactly appear to be much of a safe haven. As long as the Fed is stuck at 0% interest while inflation continues to rise, the long-run case for BTC is going to be better than for the US dollar. And for savers in many emerging markets, their central banks aren’t even trying to justify why they run double-digit inflation. These factors combine in my mind to increase adoption and justify a higher price for Bitcoin.

- I’m not going to sit here and claim that Bitcoin isn’t a speculative asset, especially the way it’s being used by those in the West. On the other hand, the mainstream media doesn’t seem to appreciate how much potential Bitcoin (and the internet in general) has to grant freedom to populations living and working in many third-world countries where monetary systems are an instrument of oppression.

- On the technical side, the $30+ billion Grayscale Bitcoin Trust (OTC:GBTC) has filed to convert to an ETF. If the application is approved, it will be a huge milestone for legitimizing crypto and will make BTC an easily investable asset class for institutional investors.

- Tether (USDT-USD) stands out as the potential black swan in the crypto world. The market cap (meaning liabilities in Tether’s case) continues to swell, while Bloomberg has reported that their assets are sketchy at best and nonexistent at worst. Tether could easily blow up in the next 6-12 months, and the wreckage would negatively impact BTC. I’d view an event like this as a buying opportunity though. Tether is probably going to collapse at some point, so be ready to rebalance your portfolio when it does.

What Price Will Bitcoin Be By 2022?

Obviously, forecasting the price of BTC isn’t an exact science, but BTC has strong momentum going into 2022. Research shows that this tends to lead to strong asset class returns, so I’m not just saying BTC is going higher because Mercury is in retrograde. Absent some sort of black swan event, I’d say the weight of the evidence suggests that it will continue to grind higher. My personal expectation is for BTC to close out the year somewhere between $70,000 and $75,000. As long as the Federal Reserve is stuck between a rock and a hard place on inflation, the path of least resistance is up for BTC.

The price of Bitcoin is known for huge rallies and crashes, and I’d expect at least one big upswing and downswing in 2022. Factors that are likely to cause Bitcoin to push higher include ETF approval, institutional adoption (especially other companies like Tesla (NASDAQ:TSLA) adding BTC to their balance sheet), user adoption, and good old-fashioned FOMO. Some risks that could cause Bitcoin to fall include a black swan involving Tether, ESG concerns, and higher interest rates in the US and EU.

Source : https://seekingalpha.com/

Other stories