PayPal Q4 Earnings: Disappointing 2022 Guidance

PayPal Q4 Earnings

Investment Thesis

PayPal (PYPL) put out guidance that took investors by surprise. PayPal is now only expecting to grow its revenues by 17% y/y in 2022, which is slower than analysts estimated.

Furthermore, crucially, PayPal’s ability to get meaningfully increase its net active accounts has come under pressure.

On the one hand, PayPal’s stock isn’t that expensive, after the share price has taken a beating these past 6 months, and it is now priced approximately 6x forward sales.

On the other hand, given that PYPL has been consistently downwards revising its own guidance over the past couple of quarters, this now puts into question PYPL’s ability to reach its 2025 targets of $50 billion in revenues.

As we go through the positive and negative aspects of this investment, I argue that investors would do well to call it a day here.

Investment Sentiment Sours Rapidly For PYPL Stock

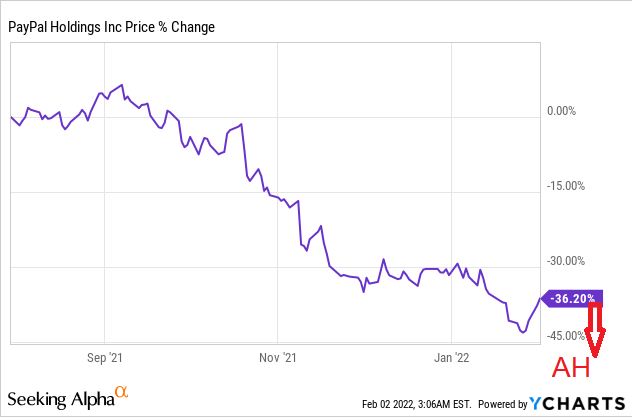

PayPal 6-month performance

The past 6 months have been brutal for PYPL. PayPal is a blue-chip. An institutional favorite. It should not see its valuation practically half. And certainly not in just 6 months. Yet, the market has been remorseless towards mid and small-cap tech companies.

PYPL is one of the first tech companies to report that is not a mega-cap. And I sincerely hope that this is not the market’s sentiment for the remainder of this earning season.

That being said, there are clear elements that justify some of its sell-off.

PayPal’s Revenue Growth Rates Slow Down

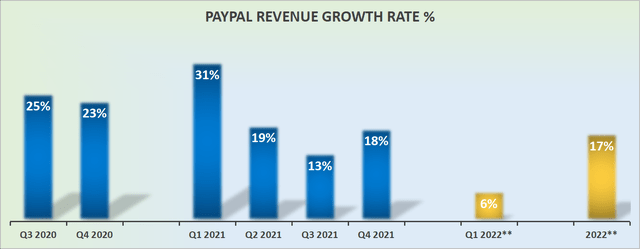

PayPal revenue growth rates

The past 6 months have seen PYPL downwards revising its guidance targets.

Last time I covered PayPal I stated,

investors are also now starting to think about 2022, and how PayPal will come up against its super-strong H1 2021?

And in the interest of full disclosure, I absolutely did not see this coming. I got this investment totally wrong.

As you can see from my quote above, I did expect H1 2022 to be tough, but for PayPal to guide for Q1 2022 to be up just 6% y/y? This took me by surprise.

I know that PayPal’s management is lowering expectations to allow for an easy beat. However, even if PayPal ultimately grows in Q1 2022 by 9% y/y or even 10% y/y, this growth rate is still far from commensurate with a high growth name.

And before readers remark the obvious, that this excludes eBay (EBAY), and that adjusted for eBay, PayPal’s revenue growth rates in Q1 would be up nearly 15%, my point stands, this is nowhere near aligned with investors expectations.

And the market will punish the stock on that basis.

PayPal’s Near-Term Prospects Now In Doubt

PayPal Q4 2021 shareholder letter

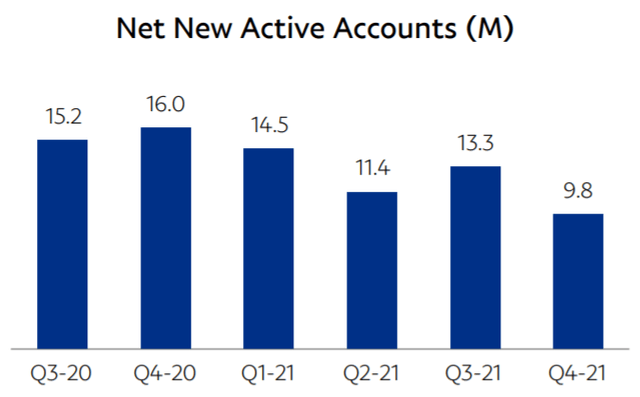

If you’ve read my work before, you’ll have seen me declare that you should follow the user growth rates more closely than any other metric. The customer knows best.

To this end, the graph above illustrates the core of the problem. PayPal’s Net New Active accounts (”NNAs”) growth rates are decelerating. You don’t want to invest in a company where its ability to drive customer growth is struggling.

Looking ahead to 2022 as a whole, PayPal is guiding at the high end to add a further 20 million NNAs. This implies that relative to 2021, PYPL active accounts this year are guided to be 5% y/y. This is simply not aligned with a high-growth platform.

For their part, during the earnings call, PYPL went to great lengths to explain that

[…] we are shifting our emphasis more towards engagement and towards driving higher value NNAs.

However, I don’t see this as being a material driver of PayPal’s future revenue growth.

Also, during the call, PYPL added,

[…] we no longer believe that the 750 million [of active accounts] medium-term […] aspiration we set last year is appropriate.

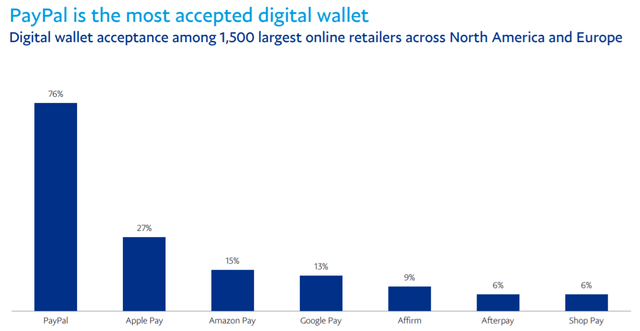

PayPal Q4 2021 results

Consequently, despite PayPal being the leading digital wallet, it appears that its ability to gain substantially more active accounts is coming under the stress of the competition.

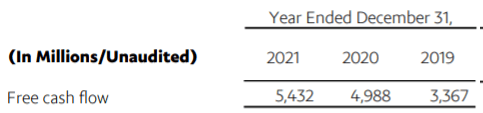

Crown Jewel: Free Cash Flow Profile

For 2022, PayPal is guiding for approximately $6 billion of free cash flow.

However, let’s make the assumption that PYPL is lowballing estimates and that its 2022 free cash flows reach $6.2 to $6.4 billion.

This implies that compared to 2021, its free cash flow will be up approximately 14% to 18% y/y.

Notwithstanding PYPL’s share price is down 15% after hours, this free cash flow growth is certainly nothing to sneer at.

PayPal Q4 2021 results

Not only is PayPal a consistent free cash flow generating company, as you can see above. But importantly, its free cash flow guidance for 2022 implies that PYPL is expecting a free cash flow margin of 21%, which is flat with the same period a year ago.

What this actually means in practical terms, is that even if investors are gloomy right now, there is, without doubt, a business model here that literally oozes free cash flows.

That being said, I question the sustainability of PayPal’s high free cash flow margins.

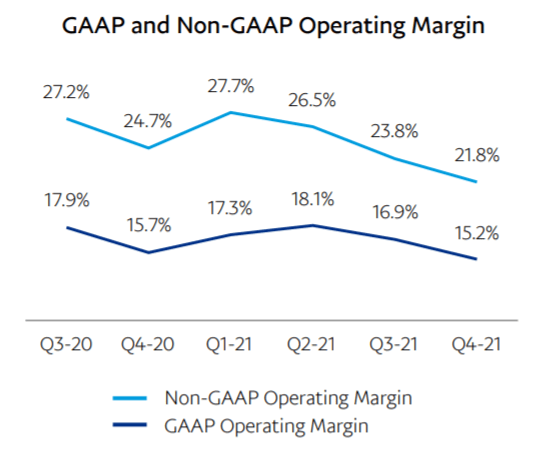

PayPal Q4 2021 results

If PYPL is seeing its operating margins compress, it will be very difficult for it to continue generating such strong free cash flow margins. There’s only so far positive working capital movements can go.

PYPL Stock Valuation – Tough To Price

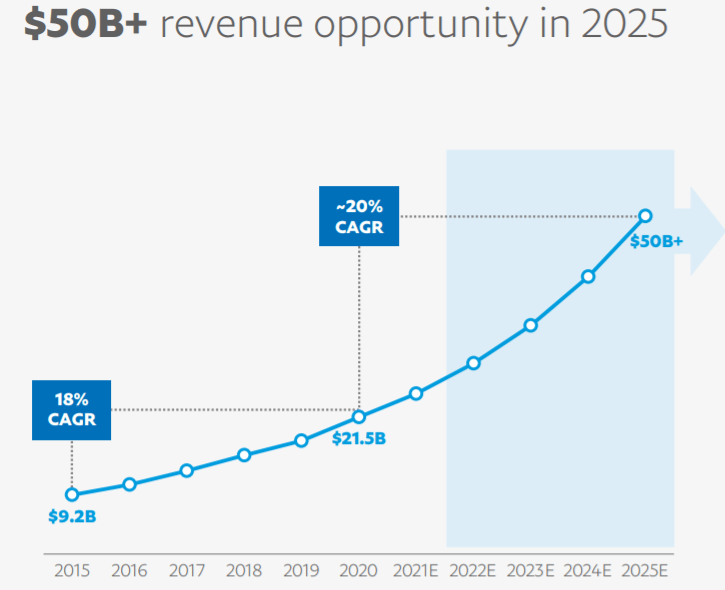

PayPal Analyst Day 2021

On the back of its analyst day, PayPal guided investors towards a 20% CAGR between 2020 and 2025.

Clearly, as we now know, 2022 is expected to fall below this CAGR is guided for the high teens instead.

Meanwhile, for their part, PayPal steadfastly remarks that in 2023 it will reignite its revenue growth rates and grow at 20% once again. However, from the investment point of view, this clearly puts into doubt PayPal’s ability to reach $50 billion in revenues by 2025, as PayPal originally guided for on its analyst day.

This most likely implies that analysts will have to downwards revise their financial models.

As it stands right now, PYPL is priced at 6x forward sales. Is it truly worthwhile paying 6x forward sales for PayPal as it now becomes less of a growth company and more of a mature operation?

The problem here is that stocks don’t trade in a vacuum. There are plenty of stocks out there right now that are being priced substantially cheaper than this, despite having plenty of visibility into their very high growth rates.

The Bottom Line

It may sound harsh of me to say this, but you either make your numbers or you make excuses. But if you don’t deliver on the first part, nobody cares about the second part.

PYPL has been through a tough period of late. And I fully expected them to be out of the woods by now. But not only isPYPL not out of the woods, in fact, they actually appear to be getting further into them.

I don’t hold any positions here. But if I did, personally, I would just bite the bullet.

There are some seriously terrific businesses out there now trading in the garbage bin. Even though many investors will be shouting to ”buy the dip”, I don’t see this as a compelling opportunity. Whatever you decide good luck and happy investing.

Strong Investment Potential

My Marketplace highlights a portfolio of undervalued investment opportunities – stocks with rapid growth potential, driven by top quality management, while these stocks are cheaply valued.

I follow countless companies and select for you the most attractive investments. I do all the work of picking the most attractive stocks.

Investing Made EASY

As an experienced professional, I highlight the best stocks to grow your savings: stocks that deliver strong gains.

-

- Deep Value Returns’ Marketplace continues to rapidly grow.

- Check out members’ reviews.

- High-quality, actionable insightful stock picks.

- The place where value is everything.

Source : https://seekingalpha.com

Other stories