Bitcoin momentarily dipped under $17,800 as auction speeds up — this occurred

Wednesday

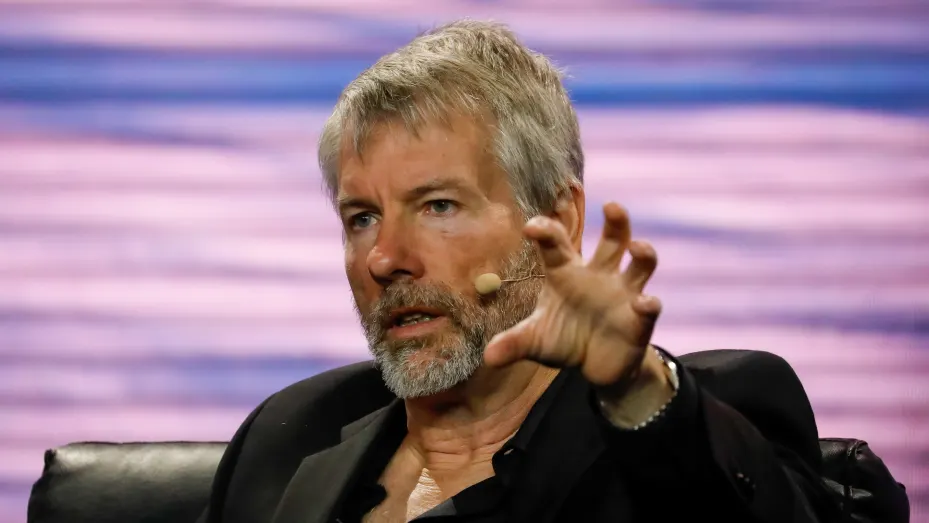

Michael Saylor, director and CEO of MicroStrategy, first got into bitcoin in 2020, when he chose to begin adding the digital money to MicroStrategy’s monetary record as a component of an unconventional depository the board methodology.

Eva Marie Uzcategui | Bloomberg | Getty Images

MicroStrategy CEO Michael Saylor showed up on CNBC Wednesday morning to examine worries around his firm, which has made a $4 billion wagered on bitcoin. Saylor has said the organization serves as the sole bitcoin spot trade exchanged reserve the U.S., so putting resources into MicroStrategy is the nearest you’ll get to a bitcoin spot ETF.

MicroStrategy has utilized organization obligation to buy bitcoin, and in March, Saylor chose to move toward normalizing bitcoin-supported finance when he acquired $205 million utilizing his bitcoin as security — to then purchase a greater amount of the cryptographic money.

“We have $5 billion in security. We acquired $200 million. So I’m not advising individuals to go out and take a profoundly utilized credit. What I am doing, I think, is giving my all to lead the way and to standardize the bitcoin-upheld supporting industry,” said Saylor, who added that public crypto excavator Marathon Digital likewise assumed out a praise line with Silvergate Bank.

As bitcoin costs failed for this present week, financial backers stressed the organization would be approached to set up more insurance for its advance, however Saylor said the feelings of trepidation were exaggerated.

Accident protection Industry Predictions for 2022

“The edge call is a fundamentally nonsensical uproar,” Saylor told CNBC recently. “It’s simply made me Twitter renowned, so I value that…We feel like we have a stronghold monetary record, we’re agreeable, and the edge credit is very much made due.”

Then on Wednesday evening, the Federal Reserve raised its benchmark loan fees 3/4 of a rate point in its most forceful climb starting around 1994. The Fed said the move was put forth trying to check out of this world expansion.

Crypto costs at first revitalized on the news as financial backers trusted we could stay away from a downturn, however that rally was brief.