In response to the economic hardships of the coronavirus pandemic, both Donald Trump and Joe Biden‘s administrations sent out stimulus checks to help low-income and medium-income Americans. Officially called Economic Impact Payments, there were three separate checks sent out.

While most Americans have already received these stimulus checks, some still haven’t claimed the full amount that they were entitled to. The good news is that these people can still get this money backdated.

Who qualifies for $1,400 per-person checks?

On the official White House government website, there is a section which details who is eligible to receive checks worth $1,400 per person as a result of the American Rescue Plan.

“Single people making less than $75,000, heads of household making less than $112,500, and married couples filing jointly making less than $150,000 qualify for stimulus checks, while people making up to $80,000 will receive partial payments,” the website explains.

It also adds that people with dependents can receive $1,400 per person and that this can include college students and seniors.

Can you still collect past stimulus payments you did not receive?

Yes, it might still be possible to receive your check when you next file a tax return.

“People who are missing a stimulus payment or got less than the full amount may be eligible to claim a Recovery Rebate Credit on their 2020 or 2021 federal tax return,” the Internal Revenue Service (IRS) explains.

What is the Recovery Rebate Credit?

Through the Recovery Rebate Credit, those who missed out on all of some of their Economic Impact Payments can ensure they receive the money they are entitled to. There is a full section on the IRS website that details how this process works.

“If you didn’t qualify for a third Economic Impact Payment or got less than the full amount, you may be eligible to claim the 2021 Recovery Rebate Credit when you file your 2021 tax return,” the IRS explains.

“You must file a return to claim the credit, even if you don’t usually file a tax return. The credit is based on your 2021 tax year information, so any third Economic Impact Payments you received will reduce the amount of the credit you’re eligible for. Your 2021 Recovery Rebate Credit will reduce any tax you owe for 2021 or be included in your tax refund. You will need the total amount of your third Economic Impact payment and any plus-up payments to claim the 2021 Recovery Rebate Credit.”

Source: https://www.marca.com/

Other stories

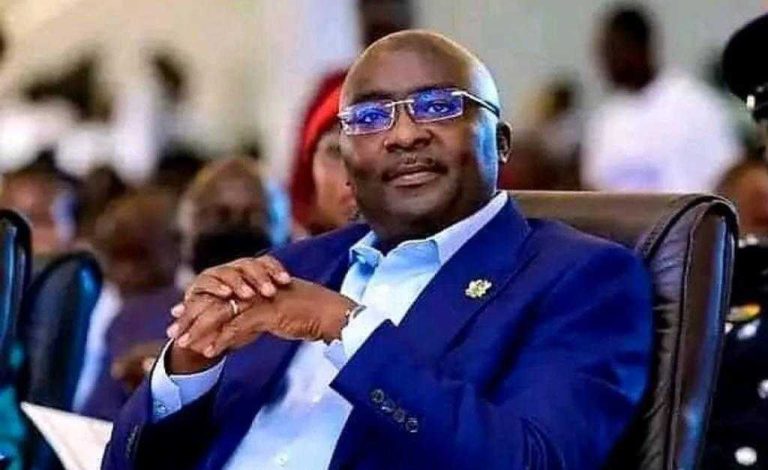

- Research shows 24% drop in Mobile Money after introducing E-levy – John Kumah

- Celebrities go crypto – but are they winning the public over, or putting them off?

- The Easiest Way To Exchange Cryptocurrency